2016 Review of Construction Activity Trends in the Medical Sector

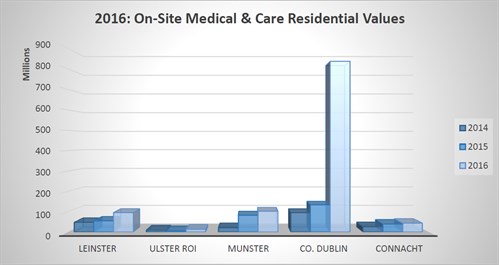

The commencement of enabling works on the New Children’s Hospital in 2016, with its updated value of €200m to €950 million, sees a growth of 245% in On-Site values to almost €1.1 billion in 2016 versus 2015. The number of Medical & Care Residential projects has actually fallen by 2% in 2016 from 186 to 183 projects.

*The increased value of the New Childrem’s Hospital to €950m will further skew the data in future reports.

Fig. 23

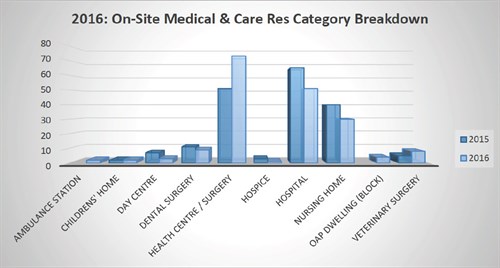

While the volume of projects on site in the Medical & Care Residential sector has remained static, the volume of primary care/surgery projects on site has increased by 43% when compared with 2015 (Fig. 24). This trend is in line with the Government pledge to take the pressure off the acute hospitals by treating patients in the community.

Fig. 24

Future Pipeline of Medical & Care Residential Projects

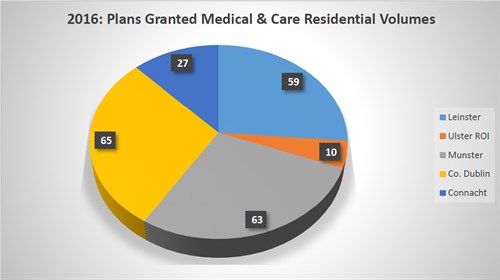

The number of projects granted planning in 2016 has fallen by 11% year on year with only 224 projects granted planning. Almost €1.2 billion in projects has been granted planning permission with the New Children’s Hospital representing the majority of the total at €950 million.

Fig. 25

The sector is trending downwards with only 222 projects submitted for planning in 2016, down from 282 in 2015 or minus 21%. All regions are experiencing this decline (Fig. 26)

Fig. 26

Medical and Care Residential Sector Activity: Q1-Q3 2016

Medical & Care Residential Sector

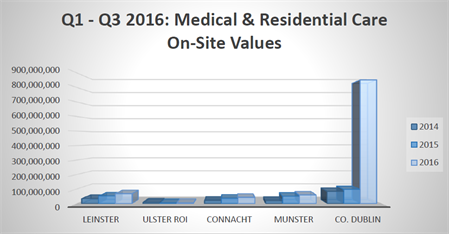

The Medical Sector has shown an increase in activity in the first 9 months of 2016. CIS estimate that over €1 billion’s worth of projects have gone On-Site in Q3 2016 (Fig. 17). This is an increase of over 300% on the same period last year.

Fig. 17

This massive jump can be accredited to the €750m National Children’s Hospital where enabling works have begun for the new hospital at St James, Dublin. If we remove this hospital from our data we get a more modest 14% increase in project value for the period. In terms of the regional breakdown, all regions have shown growth for the 9 months.

The €750m National Children’s Hospital at On-Site Stage

Future Pipeline of Medical & Care Residential Projects

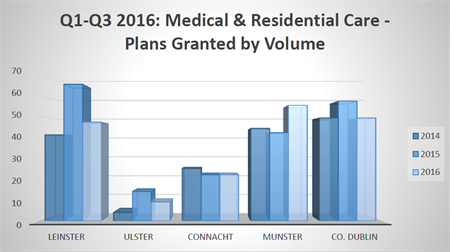

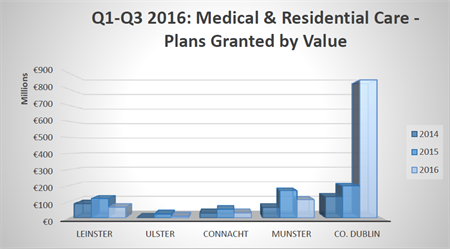

The number of projects which have been granted planning permission in the first 9 months of 2016 has fallen by 9% (Fig. 18), but when we look at from a value perspective, we see growth of 90% for the 9 months year on year, due to the National Children’s Hospital being granted permission in Q2 2016 (Fig. 19).

Fig. 18

A trend of decline in investment appears to be emerging with the number of projects granted planning down 24% to 56 in Q3 compared with Q2 2016. This trend can be further evidenced in Plans Submitted with a 17% decrease in projects for the first 9 months of 2016 when compared with 2015.

Fig. 19